I left the service thinking discipline and structure would buy me instant success online. Two years later I learned that the digital battlefield has its own rules — and that veterans often trip over two things: a motivation trap of hype, and a financing gap that chokes growth. In this post I share honest failures, surprising data about veteran-owned small businesses, and a practical, boots-on-ground playbook that pairs military systems with modern AI logistics.

Brainstorm: 4 Divergent Main Points I’m Working With

I like to start messy. Before I tighten the message, I throw four anchors on the table and let them pull against each other. These points are not meant to be linear. I want you—especially if you’re building Veteran-owned small businesses—to connect the dots yourself. This won’t be a motivational pep talk. It’s a systems talk.

Jocko Willink: “Discipline equals freedom.”

1) Systems > hype (process beats motivation)

Online culture sells energy: post more, hustle harder, stay “on.” That’s a trap. Veterans perform better with process than hype because we were trained to execute even when we don’t feel like it. The long game is checklists, repetition, and review—not mood.

2) Funding friction (Financing challenges veterans can’t ignore)

One of the biggest Veteran business challenges isn’t effort—it’s cash flow and access. Financing challenges veterans face create an approval gap that forces many of us to self-fund longer than we should. That pressure changes decisions fast, and not always in a good way.

|

Funding reality |

What it means |

|---|---|

|

32% cited credit availability as a challenge |

More “no’s” and slower growth |

|

72% used personal savings |

Higher personal risk and stress |

Marcus, a Marine vet I met at a coworking space, burned through most of his savings chasing shiny tools—new funnel software, new ads, new “secret” courses. He wasn’t lazy. He was under financial strain and trying to buy certainty.

3) AI as logistics (automation restores time and focus)

I don’t see AI as magic. I see it as logistics. It batches content, automates follow-up, and handles support so I can think clearly again. Used right, AI becomes a force multiplier that helps scale veteran-owned businesses without burning out.

4) Customer-first operations (chain-of-command → customer journey)

In service, nothing moved without clear handoffs. Online, the “chain of command” is the customer journey: attention → trust → offer → follow-up. When I map it like an operation, I stop guessing and start executing.

The Motivation Trap: Why “Grind” Fails Veterans Online

I fell into the motivation trap fast. I told myself, “Just post more. Hustle harder.” So I did. More content, more late nights, more tabs open… and the same results. That’s one of the biggest Business growth challenges veterans face online: we confuse activity with progress.

Online marketing culture sells hype—grind, manifestation, virality. But that mindset clashes with how I was trained. In uniform, I didn’t wait to “feel motivated.” I followed a process. I executed the plan. I measured what happened and adjusted. Those are real Veteran business owner skills, but they get wasted when we apply them as pure hustle instead of a system.

Here’s the reality: 77% of veteran-owned and led businesses say new customers are the key growth opportunity, yet many of us chase customer acquisition with inconsistent tactics. We post randomly, change offers weekly, and hope the algorithm saves us. Meanwhile, only 29% plan to increase staffing, so we’re trying to grow without more hands. That’s why a system matters.

A Real Example: 90 Days of Posting, Almost No Sales

A fellow vet posted daily for 90 days. Discipline was not the issue. But there was no funnel, no lead capture, no follow-up rhythm. Lots of reach. Low conversion. The grind didn’t fail because effort is bad—it failed because effort without a process is just noise.

Replace “Post Daily” With a Content Engine + KPIs

My fix was simple: stop chasing motivation and start tracking outcomes. That’s Veteran entrepreneur digital transformation in plain language—turning chaos into a repeatable machine.

-

Content engine: 1 weekly theme → 3 short posts → 1 email → 1 offer CTA

-

KPIs: reach, leads, booked calls, follow-ups sent

-

Lead magnet idea: a downloadable Content Engine Checklist worksheet

Mini-Tactic: Weekly AAR for Content

Systematic measurement beats blind hustle. Every week, I run a quick AAR:

-

What worked?

-

What didn’t?

-

What will I change next week?

|

Metric |

Target |

Actual |

|---|---|---|

|

Reach |

1,000 |

___ |

|

Leads |

20 |

___ |

|

Follow-ups |

20 |

___ |

Simon Sinek: “People don’t buy what you do; they buy why you do it.”

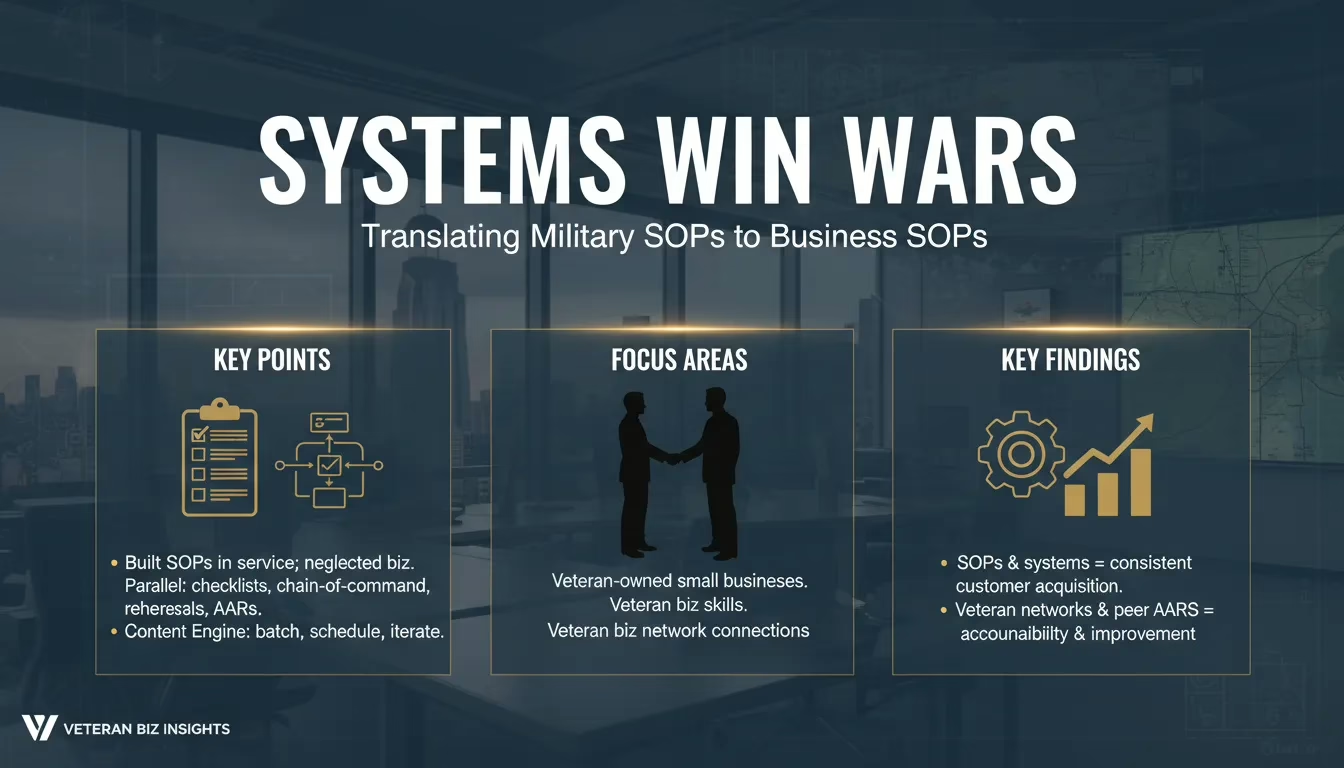

Systems Win Wars: Translating Military SOPs to Business SOPs

I built SOPs for everything in service. Weapons checks. Comms checks. Convoy briefs. Rehearsals. I didn’t “feel motivated” to do them—I did them because the mission demanded it. Then I became a Veteran business owner and tried to run my online business on vibes. That’s where many Veteran-owned small businesses get stuck: we abandon the system that made us effective.

Jocko Willink: “Discipline equals freedom.”

Veteran business owner skills: SOPs are the real advantage

Nearly 2 million veteran-owned businesses operate in the U.S. Veterans employ more than 5 million Americans and generate $1.3 trillion in sales. We already have the mindset—what we need is translation. SOPs and repeatable systems enable consistent customer acquisition because they remove guesswork and make results repeatable.

Direct parallels: from chain of command to customer journey

In business, “chain of command” becomes a customer journey map: who sees the offer, who trusts it, who approves the sale (them, their spouse, their boss), and what follow-up moves them forward. I treat it like routing a request—no step, no sale.

My weekly “mission brief” template

-

Objective: one offer to push

-

Tasks: 3 content pieces, 1 email, 1 lead magnet tweak

-

Timeline: batch Monday, schedule Tuesday, review Friday

-

Measures: leads, replies, booked calls

Swap manual work for systems that compound

-

Manual posts → Content engine: batch, schedule, iterate using a content calendar.

-

Manual outreach → Lead magnet + emails: capture leads, then run an autoresponder sequence.

-

Manual sales → Predictable funnel: simple pages, clear CTA, and a follow-up cadence tracked in a CRM.

Veteran business network connections = built-in AARs

I plug Veteran business network connections into my SOPs: peer reviews, weekly check-ins, and quick AARs. Same format: what happened, what worked, what didn’t, what we change. Small, reproducible SOPs compound—and that’s how you scale without burnout.

Exercise: write three SOPs this week—content, lead capture, follow-up.

AI as a Force Multiplier: Practical Tools, Not Magic

When I started building online, I made the same mistake I see other vets make: I tried to do everything by hand. Then I used AI to batch content in hours instead of days—game changer. That’s the heart of Veteran entrepreneur digital transformation: we don’t need more motivation. We need better tools inside a disciplined system.

Jocko Willink: “Discipline equals freedom.”

Veteran business owner skills + AI = logistics

AI isn’t a replacement for Veteran business owner skills like planning, repetition, and accountability. It’s logistics: better resource allocation, faster iteration, and less cognitive load. Research backs this up—batching and automation restore time for strategy, but only if I pair AI with clear SOPs and review.

-

Content batching: outlines, hooks, captions, and repurposed posts in one sitting

-

Email automation: autoresponders that follow up every time, no excuses

-

Customer support bots: basic FAQ coverage so I’m not answering the same question 30 times

-

Funnel testing: small changes, measured results—an AAR with data

My simple workflow (prompt → batch → schedule → AAR)

I run it like an operation:

-

Ideation prompt to generate topics and angles

-

Batch content (drafts + variations)

-

Schedule posts and emails

-

Monitor results and run an AAR weekly

Example prompt:

Give me 10 post ideas for veterans starting online business. Include a hook, 3 bullets, and a CTA.

Outcomes I track

-

Time saved (hours back for strategy)

-

Higher output quality through iteration

-

Consistent follow-ups that don’t depend on mood

Two-week pilot plan (one SOP)

Week 1: pick one SOP (content or email), build templates, and set human review for brand voice and compliance. Week 2: automate scheduling, add a basic chatbot for FAQs, and run one funnel test. This matters for vets navigating Online lenders fintech veterans realities too—32% of majority-veteran-owned firms applied for funding from online lenders, and many reported lower satisfaction and higher interest rate complaints. I can’t afford sloppy systems, and neither can you.

Financing Realities: The Approval Gap and What I Did About It

Financing challenges veterans: the “approval gap” is real

When people say credit availability, they mean one simple thing: can you actually get approved for money at a fair rate when you need it? The data isn’t flattering. About 32% of veteran-owned firms cite credit availability as a financial challenge (Fed communities/related surveys). That’s the Approval gap financing veterans run into—qualified people still hearing “no,” or “yes, but…” with terms that hurt.

SBA Office of Advocacy (paraphrase): Veteran-owned businesses can face higher denial rates for loans.

Access to capital veterans: I used savings first (and I tracked the burn)

I did what most of us do: I leaned on personal savings. Roughly 72% of majority-veteran-owned firms funded their businesses that way (TD Bank/Fed communities reporting). It works—until it doesn’t. So I started measuring my personal savings burn rate like a mission metric:

Burn Rate = Monthly business shortfall (expenses - revenue)Runway (months) = Savings / Burn Rate

Online lenders fintech veterans: fast money, slower regret

I also looked at online lenders because they move fast. Around 32% of veteran applicants went to fintech lenders, compared with 18% to small banks and only 1% to CDFIs. But satisfaction lagged, often due to higher interest and unfavorable terms (Fed communities). I learned to shop rates, read fees, and treat “easy approval” as a warning label.

What I did instead: build predictable revenue before borrowing

The best hedge against high-cost financing is predictable revenue. I built a simple funnel, then used AI to run SOPs: weekly content batching, email follow-up, and lead tracking. One vet I coached avoided expensive fintech by increasing his conversion rate 10% after tightening his landing page and automating follow-ups—same traffic, more cash.

My three-month runway plan (systems first)

-

Forecast revenue weekly (leads → calls → closes) and update runway.

-

Cut burn to essentials; delay “nice-to-have” tools.

-

Stack funding: savings + small microloan + local options (state veteran programs, nearby CDFIs).

Customer Acquisition & Growth: Chain-of-Command for Sales

Veteran business customer acquisition starts with a mission plan

When I started selling online, I stopped “posting and praying” and built a chain-of-command for sales. I map the customer journey like a mission plan: objective (what they buy), triggers (what makes them act), and exit criteria (what proves the step worked). That’s how I handle the business growth challenges veterans face—too many choices, not enough structure.

New customers are the primary growth lever, and I’m not guessing. 77% of veteran-owned and led businesses say gaining new customers is a key opportunity. So I treat acquisition like logistics: repeatable, trackable, and boring in the best way.

Low-cost pipeline: lead magnets + automated funnels

I use AI to build predictable pipelines without big budgets or extra staff. That matters when access to capital veterans is tight and every dollar has to earn its keep.

-

Lead magnets: checklists, mission-brief templates, SOP snippets

-

Automated funnel: landing page → email sequence → call booking

-

Follow-up SOP: “no response” nudges, referral ask, reactivation

Test offers like a combat rehearsal (small, fast, measured)

I don’t scale based on vibes. I run quick iterations with clear metrics, then let AI help me tighten the copy and sequence.

|

Metric |

Minimum to hit before scaling |

|---|---|

|

Landing page conversion |

20–35% |

|

Email click rate |

2–5% |

|

Call-to-close rate |

15–30% |

Only after that do I consider ads or loans—because 71% of veteran-led firms cite inflation/high rates as a top concern, and only 34% expect better performance in the next 12 months. That’s why scaling must be cautious and data-driven.

TD Bank survey (paraphrase): Many veteran-led firms are cautious about the economic outlook, so they’re careful with hiring and spending.

One time, a single webinar attendee didn’t buy. My follow-up sequence did the work: three value emails, one case study, one simple “still stuck?” check-in. They became a recurring client. Retention beats random acquisition—every time. I also lean on veteran networks for first referrals, then systematize what works.

Tactical Playbook: A 30–90 Day Plan I’d Follow Today

Jocko Willink: “Discipline equals freedom.”

Days 1–7: Audit + 3 SOPs (Veteran business owner skills)

I would start with a clean audit: where do leads come from, what do I post, and how do I follow up? Then I’d write three simple SOPs so I stop “winging it.” AI helps me draft fast; my discipline makes it real.

SOP header template:

Purpose | Trigger | Tools | Steps (1–7) | Quality Check | Owner | Time to Complete

Days 8–21: AI content batching + KPIs

I would use AI prompts to batch two weeks of content in one sitting (posts, emails, short scripts). Then I’d schedule it and track KPIs like a mission board.

-

Metrics: conversion rate, CAC, LTV, email opt-in rate

-

Cadence: 3 posts/week + 1 email/week minimum

Days 22–45: Lead magnet + automated funnel + A/B test

I would launch one simple lead magnet (optional: “30–90 Day Tactical Playbook” download). Then I’d build a 5-email automated follow-up and run one A/B test (headline or CTA). Short, disciplined sprints with measurable AARs de-risk growth.

Days 46–75: Measure, run AAR, iterate

I know this works because it’s how we improved in service: review, adjust, repeat. I’d run weekly AARs and tighten the funnel based on data, not feelings.

AAR checklist:

-

What was supposed to happen?

-

What actually happened?

-

What caused the gap?

-

What will I change next week?

Days 76–90: Veteran entrepreneur financing decision (Personal savings business startup)

I would only consider Veteran entrepreneur financing after I see predictable revenue. Financing should follow revenue, not precede it. If I borrow, I rate-shop hard and avoid fintech traps (daily/weekly payments, hidden fees).

|

Runway Calculator Idea |

Formula |

|---|---|

|

Runway months |

(Cash on hand ÷ monthly burn) |

Ongoing: weekly AARs, monthly financial pulse, quarterly strategy reviews—like PMEs. With only 34% expecting improved performance and 29% planning to add staff, I’d scale carefully and let systems lead.

Wild Cards: Hypotheticals, Quotes, and Odd Comparisons

Military veteran business ownership: What if a platoon ran a Shopify store?

Humor me. If my old platoon got tasked to run a Shopify store, we wouldn’t “wing it.” We’d assign roles, write SOPs, and run daily briefings like it was a mission.

-

PL = sets the goal and priorities (weekly revenue target)

-

PSG = keeps the rhythm (daily checklist, deadlines)

-

Team leads = product pages, ads, customer support

-

AI = the tireless specialist: drafts copy, tags FAQs, tests headlines

That’s Veteran entrepreneur digital transformation in plain language: same discipline, better tools.

Funnels are supply lines (break them and everything stalls)

I think of funnels like supply lines. Traffic is the convoy. The landing page is the checkpoint. Email follow-up is the resupply run. If one link breaks—no ammo, no fuel, no momentum. AI helps me spot weak points fast: which email gets ignored, which page leaks leads, which offer needs a rewrite.

Action + meaning: two quotes I keep close

“Discipline equals freedom.” — Jocko Willink

“People don’t buy what you do; they buy why you do it.” — Simon Sinek

One keeps me moving. The other keeps me honest. Together, they stop me from chasing hype and forgetting purpose.

Quick tangent: Sgt. Ana, two SOPs, one chatbot

I met a vet I’ll call Sgt. Ana. She ran a local service business and was drowning in repeat questions. She wrote two SOPs: Lead Intake and Booking + Follow-Up. Then she added a simple chatbot to answer FAQs and collect details after hours. Within weeks, she stopped losing leads at night and started showing up to jobs with clean info already logged.

Veteran business network connections: a digital opportunity hiding in plain sight

Veterans own nearly 2 million businesses in the U.S., employing 5+ million Americans and generating $1.3T+ in annual sales (U.S. SBA). Imagine that network turned digital—referrals, partnerships, and shared SOPs at scale.

Question: What’s one SOP you can write this week? Answer in the comments—and share a quick story from your own build.

Conclusion & Call to Action: Operate Like You Always Have — With Better Tools

When I opened this post, I said you already understand structure, command, and systems. I’m closing it the same way: I don’t need to become someone else to win online. I need better logistics. The internet rewards the same things the service rewarded—clear roles, repeatable actions, and honest reviews. The battlefield just went digital, but the mission hasn’t changed.

Veteran business challenges don’t require a new personality—just a tighter system

Nearly 2 million veteran-owned small businesses exist in the U.S., which tells me we’re not short on grit or leadership. But the numbers also explain why so many stall: 32% cite credit availability as a challenge, and 72% rely on personal savings. That financing gap is real, so I treat cash like ammo. I don’t “hope” revenue shows up—I build predictable funnels and simple offers first, then I consider bigger expenses or loans.

Veterans’ business ownership support works best when you bring SOPs and AI together

Here’s the unlock I’ve seen again and again: systems and AI together create leverage. AI isn’t magic; it’s the logistics section you always wished you had. I keep the discipline, I write the SOPs, and I let AI handle the repeatable work—drafting content, organizing outreach, testing messages, and supporting customers—so I can stay focused on decisions and leadership.

“Discipline equals freedom.”

— Jocko Willink

Your next move: one SOP, one AI pilot, one AAR per week

Start small. Write one SOP you can run this week (lead follow-up, weekly content batch, or a simple email sequence). Then run one AI pilot to speed it up. End the week with one after-action review: what worked, what didn’t, what you’ll change.

If you’re a veteran owner, comment with one SOP you’ll implement—I’ll read and respond. If you want, I’ll also share a downloadable SOP template. And remember help exists through local veteran entrepreneur programs and CDFIs that understand Veterans business ownership support.

Discipline plus tech equal’s leverage.

TL;DR: Veterans bring unmatched discipline but often abandon systems online; pairing military-style processes with AI (content batching, automated funnels, fintech savvy) closes financing and growth gaps for veteran-owned small businesses.

Leave a Reply

You must be logged in to post a comment.