Last winter I had a week that should’ve “broken” my progress: a surprise family obligation, two nights of terrible sleep, and a to-do list that grew like it was being fed after midnight. I did what I used to do—I tried to hype myself up. Coffee. Podcasts. A pep talk in the mirror (yes, really). It worked… for about three hours. Then the familiar drop: guilt, scrambling, and that sinking feeling that my income depended on my mood. That week was the moment I finally admitted something I’d been dodging: I wasn’t failing at motivation. Motivation was doing what motivation does—showing up flashy and leaving early. What I was missing was a system. Something that could carry the weight when I couldn’t.

The Campfire Problem: Motivation Burns Out Fast

I used to treat income like a campfire. Every day, I’d feed it with posts, hustle, and endless to-dos. If I skipped a day—just one—the flame sputtered out. And it always seemed to die on the day I needed it most. That’s the hidden trap of relying on motivation: constant attention, constant effort, one missed day and it dies.

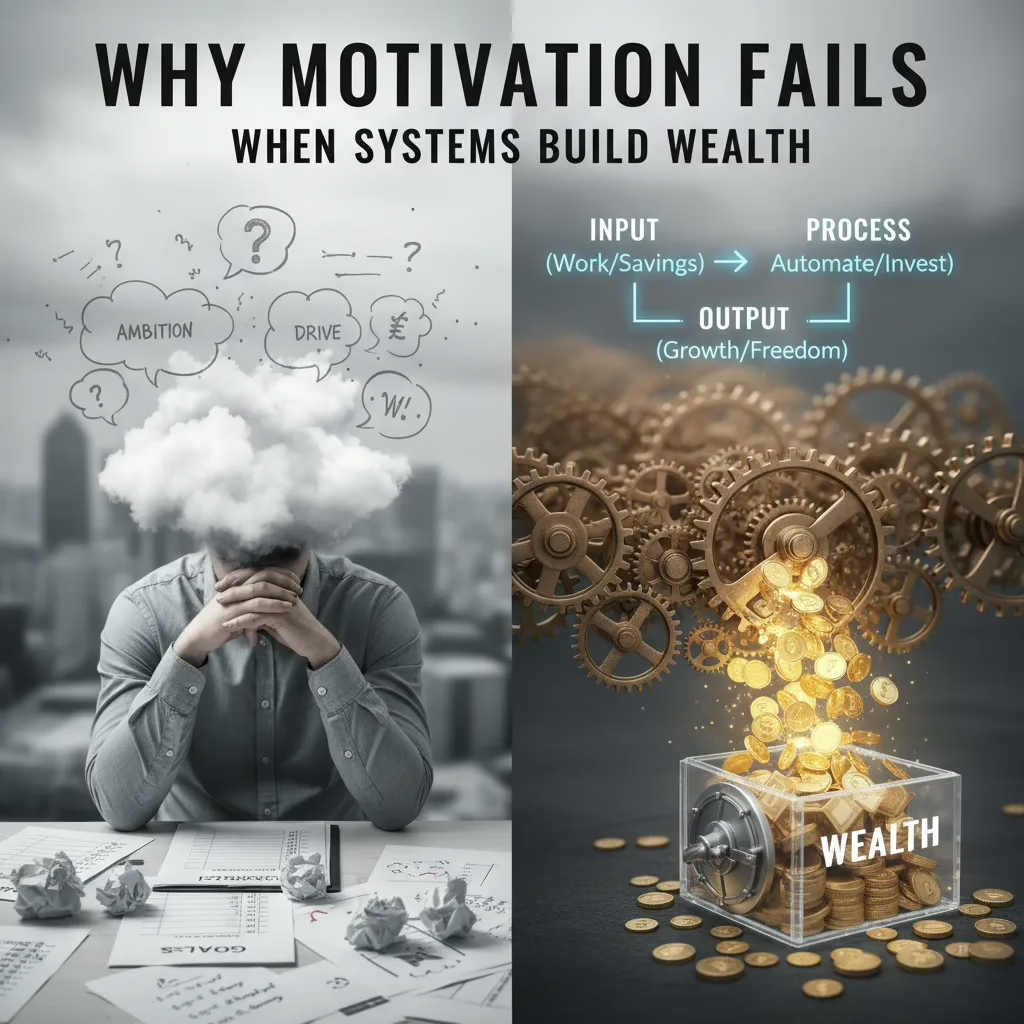

Motivation feels productive. It creates urgency, gives me a quick identity boost, and makes ‘busy’ look like progress. But here’s what I learned the hard way: busy doesn’t build wealth. My routine was a loop—post, hustle, stay busy, but nothing compounded. I’d repeat the cycle, each lap adding more frustration and less hope. There was no time freedom growth, just a rainbow-colored calendar and a bank account that didn’t get the memo.

The real cost of missing a day wasn’t just lost time. It was the mental reset tax: the shame, the need to restart, the awkward re-explaining to myself and others. I’d stare at my calendar, packed with color-coded tasks, but my financial planning for 2026 looked more like wishful thinking than a real wealth building strategy.

Here’s the reframe I wish I’d heard earlier: if the plan requires me to feel great every day, it’s not a plan—it’s a wish. That’s when I realized compounding wasn’t happening. I wasn’t building systems work into my life. I was just feeding the fire, hoping it wouldn’t go out.

James Clear said it best: “You do not rise to the level of your goals. You fall to the level of your systems.”

If you want income that survives bad days, busy weeks, and real life, you don’t need more motivation. You need a system that carries the weight.

The Real Problem: I Was Taught to Grind, Not Design

For years, I believed what ‘grind culture’ taught me: effort equals virtue, and structure is optional. Spoiler: it’s not. I was taught to grind. Not to design. Hard work feels productive, but without structure, it leaks—like carrying water in a cracked bucket. I’d post daily, hustle in the DMs, send custom proposals, and scramble to keep up with inconsistent content. But nothing compounded. Nothing scaled. I was always busy, but my income was stuck trading time for money.

Looking back, the signs were obvious:

-

Repeating the same explanations to every new client.

-

Reinventing content instead of reusing what worked.

-

Relying on last-minute bursts of motivation to get things done.

Here’s a slightly uncomfortable admission: sometimes, I used hustle as a way to avoid deciding what actually matters. It felt safer to stay busy than to design a system. But as Cal Newport says,

“Clarity about what matters provides clarity about what does not.”

Design beats grind because it forces choices: what I say, where I send people, what happens next. When I ran a micro-experiment and tracked which tasks actually moved revenue (versus just soothing my anxiety), the results stung. Most of my ‘busy work’ didn’t create scalable income or build systems automation. It just kept me spinning my wheels.

Real design is about repeatability and reducing cognitive load. It’s about building scalable income sources—systems that run without constant attention. With progressive taxes eating up 32–37% of high incomes and lifestyle inflation always lurking, grinding harder isn’t enough. I had to learn to delegate, automate, and create processes that could run on their own. That’s when things started to change.

The System Bridge Question That Changed My Week (and My Wallet)

For years, I obsessed over the wrong question: “How do I stay motivated?” It sounds noble, but it quietly assumes I’ll keep failing. Every day felt like a battle with my own willpower. If I missed a day, my progress fizzled—like a campfire left unattended. That’s when I found the question that changed everything: “What can run without me?” That’s the system bridge.

Let’s play a wild-card scenario: Imagine I lose my phone for 48 hours. Does my income pause, panic, or proceed? If everything grinds to a halt, I’m not building wealth—I’m babysitting it.

So, I started building systems—not just habits. Here’s what “runs without me” looks like in practice:

-

Scheduled content that posts itself (even when I’m offline)

-

Automated follow-ups and simple offers that don’t need my daily hustle

-

Clear boundaries—so I’m not always “on call” for my business

The first morning I woke up to a sale I hadn’t manually chased, I felt equal parts proud and suspicious. Was it a glitch? Nope—just a system doing its job. (Still checked my bank app three times, just in case.)

This approach isn’t just for business. Automated savings strategies move money before I can spend it. Passive income ideas for 2026 and beyond mean my financial planning doesn’t depend on my mood or memory. As BJ Fogg says,

“Help people do what they already want to do.”

I wanted to build wealth—systems just made it easier.

-

If a step requires my mood, my memory, or my last-minute energy… it’s not system-ready.

Build Systems Work: One Message, One Path, One Next Step

When I finally understood that motivation fades but systems last, everything changed. The secret to build systems work is making things so clear and simple that they run with almost no effort—like flipping a switch and watching the lights come on. Here’s what I learned (after 12 tries and a lot of public mistakes):

-

One clear message: This is the sentence I want people to remember, even if they’re just skimming. It took me a dozen drafts to get it right. If your message isn’t crystal clear, people tune out. Donald Miller said it best:

“If you confuse, you lose.”

For example, my newsletter signup page says exactly what you’ll get and why it matters—no fluff, no jargon.

-

One clear path: Once someone’s interested, where do they go next? There’s no maze, no menu with 14 options. Just one obvious direction. For me, that’s a simple lead magnet or a consult call button—one click, no confusion. When you build systems automation, you’re designing a journey, not a scavenger hunt.

-

One clear next step: What’s the smallest action someone can take right now, without needing a pep talk? Maybe it’s entering their email, booking a call, or checking out a product. The easier you make this, the more scalable your income becomes. A landing page plus one automated email beats a dozen chaotic DMs every time.

Confusion is the enemy of automation. If I have to explain my offer over and over, I burn out—and so does my audience. My ‘anti-burnout’ rule: if I can’t explain it in one breath, it’s too fuzzy. Build systems work because they let you delegate, automate, and repeat, so your income grows even when you’re not grinding. That’s how you create scalable income that runs like electricity—steady, reliable, and always on.

Create Scalable Income Without Worshipping Hustle

For years, I believed the only way to build wealth was to grind harder. But motivation fades, and hustle alone kept me stuck on a hamster wheel—always busy, never building. Real wealth starts when you create scalable income that doesn’t collapse the moment you take a break.

Here’s my personal litmus test: Can this produce results when I’m at 60% energy? If the answer is no, it’s not scalable. Systems are the bridge. Like Naval Ravikant says:

“Seek wealth, not money or status. Wealth is having assets that earn while you sleep.”

Scalable income isn’t about working less; it’s about not restarting from zero every day. Think digital products, templates, licensing, evergreen content, or referral partnerships—passive income ideas that work for real people, not just tech moguls. The best passive income streams I’ve seen (and built) live on a spectrum—from “mostly active” to “mostly automated.”

Here’s a gentle warning I learned the hard way: “Passive” usually means front-loaded. You build once, then maintain. For example, I once spent a weekend creating a simple checklist template for my audience. That single asset has been downloaded hundreds of times, with zero extra effort from me. The magic? I documented the process once, then reused it until it felt boring.

-

Document once, reuse often.

-

Design systems that run at 60% energy.

-

Choose income streams that compound, not collapse.

Building scalable income is about shifting from daily pushing to periodic maintenance. You’re not escaping effort—you’re just making sure your effort compounds, instead of leaking away. That’s the real power of systems: flip the switch, and it runs.

Invest Cash-Flowing Assets (So Your Effort Isn’t the Only Engine)

For years, I thought income was all about how hard I worked. If I stopped, the money stopped. But everything changed when I shifted from “income = me working” to “income = a mix of work + assets.” That’s when I started to invest in cash-flowing assets—things that pay me again and again, even when I’m not grinding.

In plain English, cash-flowing assets are anything that puts money in your pocket on repeat. Think:

-

Rental income properties (monthly rent checks)

-

REIT investments income (real estate exposure, no landlord headaches)

-

Bonds (steady interest payments, typically 2–5% annual returns)

-

Dividends from stocks or royalties from creative work

Real estate investing was my first big “system” move. Rental properties can be powerful, but let’s be real—they come with maintenance, management, and the occasional midnight call. That’s why I also love REITs (Real Estate Investment Trusts). They let me invest in real estate, collect income, and skip the “toilets and tenants” part. REIT investments income is a game-changer for anyone wanting real estate exposure without becoming a landlord.

Then there are bonds—the quieter cousin in my portfolio. They don’t make headlines, but they deliver steady, predictable payouts. In 2026, bonds are still offering that 2–5% passive income range, which helps balance out the riskier stuff.

Here’s my rule: I match assets to my temperament, not just to returns. Some people thrive on hands-on real estate investing. Others (like me, sometimes) prefer the simplicity of REITs or bonds. The point is, systems aren’t just about workflows—they’re about building money machines that run, even when I’m not.

Warren Buffett: “If you don’t find a way to make money while you sleep, you will work until you die.”

Automated Savings Strategies: My ‘Future-Me’ Autopilot

I stopped trusting willpower with money the same way I stopped trusting willpower with content. Motivation is a spark, but systems are the switch. The first real change I made? I set up automated savings strategies—boring, but life-changing. Every month, my savings transfers, investment contributions, and bill payments run on autopilot. No more “should I save this month?” or “did I remember to invest?” It just happens, rain or shine.

Why does automation work so well? It kills decision fatigue and shields me from emotionally expensive days. When life gets busy (or I’m tempted by a shiny new gadget), my system keeps building wealth in the background. This is high income budgeting at its best: less effort, more consistency, and truly predictable results.

Here’s the trap: as income rises, so do temptations. Lifestyle inflation control is the name of the game. If I don’t set rules, every raise gets eaten by “just one more upgrade.” My rule of thumb? I save 50% of any income raise before I even think about upgrading my lifestyle. Research backs this up—saving half of every raise is a proven way to build wealth, especially when progressive tax brackets (32–37%) already take a big bite.

A quick aside: I still buy nice coffee. I just don’t let coffee become a financial plan. As Ramit Sethi says,

“Spend extravagantly on the things you love, and cut costs mercilessly on the things you don’t.”

Automated savings investments are my ‘future-me’ autopilot. It’s the same “flip the switch” mindset I use for building content systems—except now, it’s building my wealth. No more grinding, no more leaks. Just a system that quietly carries the weight, even on my off days.

Reinvest Profits Lifestyle: The Boring Choice That Gets Loud Later

Every time I hit a new income milestone, the temptation is real: celebrate by upgrading my life. I’ve done it—booked the trip, bought the gadget, and then wondered where the money went. It’s easy to let “we deserve this” become the default after a win. But here’s what I’ve learned: the reinvest profits lifestyle is the system-friendly move that actually builds wealth.

Instead of letting new expenses become ‘normal,’ I now reinvest profits into assets and growth opportunities before anything else. This isn’t just about stocks or real estate. Sometimes, it’s:

-

Improving my offer or product

-

Hiring help to buy back my time

-

Adding to investments for compound growth reinvestment

It’s not glamorous at first. In fact, it feels like delayed gratification. But that’s the messy truth: reinvesting profits can be boring—until the second flywheel spins up. Suddenly, the system gets loud. Results compound. The grid gets stronger, like flipping a switch and watching the lights stay on, month after month.

I’ve learned to spot lifestyle inflation when I start saying “we deserve this” more than “does this help us?” That’s my cue to pause. My tiny ritual: a profit pause. After a good month, I wait 48 hours before any big purchase. This window gives me space to ask if the money could work harder elsewhere.

Morgan Housel said, “Wealth is what you don’t see.”

For me, the reinvest profits lifestyle is a system, not a mood. It’s a rule that strengthens the grid and leads to less effort, more consistency, and predictable results. That’s how reinvest profits assets and compound growth reinvestment become the boring choice that gets loud later.

A Quick Tax Detour (Because 2026 Me Will Thank Me)

I used to avoid taxes like they were a pop quiz—then I realized avoidance is expensive. As I started building systems for income, I saw that taxes are a system too. They have rules, triggers, and defaults that can either work for you or against you. If you’re earning into the higher brackets (think 32–37%), the difference between guessing and planning can be massive.

That’s where strategic income deferral comes in. Instead of letting all my income hit in one high-tax year, I learned to shift some of it into the future. This isn’t just about “paying less tax”—it’s about using tax optimization strategies to smooth out the spikes and dips. For some high earners, deferred compensation plans (like NQDCs) let you push income into years when you might be in a lower bracket. It’s not for everyone, but it’s a real tool for those who qualify.

Here’s the key: your tax strategy should match your goals and timelines. I used to think the goal was to minimize taxes at all costs. Now, I see it’s about aligning my cash flow with my life plans. Sometimes, paying a little more now means more flexibility later.

My personal boundary? When the numbers get real, I get advice. Guessing is not a strategy. I want my future self to be free from “what-if” worries—like Suze Orman says,

“A big part of financial freedom is having your heart and mind free from worry about the what-ifs of life.”

In the end, taxes aren’t just a bill—they’re a system. And just like with income, the real win comes from design, not grind. You don’t need more motivation. You need a system that carries the weight—even when it comes to taxes.

Conclusion: Flip the Switch, Then Protect the Grid

Here’s my closing belief: motivation is a spark, but systems are the wiring. I used to chase that spark, thinking if I just stayed fired up, I could build wealth and hit my financial independence goals. But if my income collapses after one off-day, the fix isn’t more hype—it’s better design. Systems work because they keep the current flowing, even when I’m not there to stoke the fire.

Every month, I run the simplest system audit: Is my message still clear? Is the path still simple? Is the next step obvious? If I can answer yes, I know my grid is protected. That’s how I keep wealth building momentum, not just for the good days, but for the busy weeks and the real-life curveballs.

Where do you start? Today, not someday. Automate one money move—maybe a savings transfer or an investment contribution. Then, systematize one business move—like scheduling content or delegating a repeatable task. That’s how you build systems work into your daily life, so your progress doesn’t depend on how you feel each morning.

I like to picture future-me as a tired electrician, grateful that past-me labeled every circuit breaker. When life gets hectic, I don’t have to guess—I just flip the switch, and the lights stay on. Annie Duke said it best:

“You can’t make good decisions without good process.”

That’s the heart of it. Good systems protect your grid, so your income survives the storms.

If you want income that survives bad days, busy weeks, and real life, build something that lasts. Because life is the point. I’m off to automate my next money move—one more wire in the grid. Remember: You don’t need more motivation. You need a system that carries the weight.

TL;DR: Motivation fades; systems don’t. If you want income and wealth-building that survives bad days, design a simple system: one message, one path, one next step—then automate, delegate, and reinvest so results compound without constant hustle.

Leave a Reply

You must be logged in to post a comment.